CO IT a.k.a GONZALO CO

Luke 8:17

“For Nothing is secret, that shall not be made manifest; neither anything hid, that shall not be known and come abroad.”

My Dear Friends,

Based on the “100 PARAGRAPHS” of my “GREEN CROSS” Saga, the NBI conducted an investigation and made the following Report-

NBI FORM NO. 1

(Revised 1997)

NATIONAL BUREAU OF INVESTIGATION

| NBI CASE No. : C06-09031 UNIT CASE: |

DATE ASSIGNED: DATE REPORTED: |

REPORTED BY: SRA J. T. JALAGAT |

| TITLE OF THE CASE: SUBJECT: ANTHONY CO, ET. AL VICTIME: CO IT aka GONZALO CO |

NATURE OF CASE: Estafa, Falsification and Tax Evasion |

| TYPE OF REPORT: | INITIAL ( ) | PROGRESS ( ) | FINAL (X) |

- NAME & PERSONAL CIRCUMSTANCES OF COMPLAINANT (REQUESTING PARTY OR DIRECTING PARTY).

CO IT aka GONZALO CO, Filipino, of legal age, a resident of 2639 Zamora St., 1300 Pasay City, Metro Manila.

- ACTION SOUGHT/DIRECTED

To conduct a thorough but discreet investigation on the alleged criminal activities, particularly for alleged violation of the National Internal Revenue Code (tax evasion), violation of anti-money laundering law and other criminal laws against Subjects.

- MATERIAL ALLEGATIONS OF THE COMPLAINT (REQUEST OR DIRECTIVE).

Complainant CO IT alleged that he organized Gonzalo Laboratories which was later incorporated to Gonzalo Laboratories, Inc. (now Green Cross, Inc.) however through the manipulations of Subjects, he was ousted from the company and was deprived of his entire shares. He further alleged that the company had not properly reported its income for the past several years and are allegedly defrauding the government millions of taxes.

| REVIEWED/APPROVED | DO NOT WRITE IN THESE SPACES |

|

HA CLARO C. DE CASTRO, JR. Chief, Interpol Division |

|

| COPIES OF REPORT: | |

| No. of pages per copy: |

CERTIFIED XEROX COPY

FROM THE ORIGINAL COPY

ROCHELLE B. GELLADO

ACTING CHIEF, RECORDS & EVIDENCE SECTION

NAMES AND PERSONAL CIRCUMSTANCES OF PRINCIPALS (SUBJECT/VICTIM).

Subject/s:

- ANTHONY A. CO, Filipino, of legal age, a resident of #408 Agoncillo St., Ayala Alabang, Muntinlupa City;

- PETER A. CO, Filipino, of legal age, a resident of #410 Agoncillo St., Ayala Alabang, Muntinlupa City;

- NANCY D. CO, Filipino, of legal age, a resident of #410 Agoncillo St., Ayala Alabang, Muntinlupa City;

- MARY CO CHO, Filipino, of legal age, a resident of #412 Agoncillo St., Ayala Alabang, Muntinlupa City;

- SO HUA T. CO, Filipino, of legal age, a resident of #844 Acacia Avenue, Ayala Alabang, Muntinlupa City;

- MICHAEL ANTHONY CO, Filipino, of legal age, a resident of #408 Agoncillo St., Ayala Alabang, Muntinlupa City;

- ANN MARIE Y. CO-IMPERIAL, Filipino, of legal age, a resident of #408 Agoncillo St., Ayala Alabang, Muntinlupa City;

- JOANNA LIZA CO YAP, Filipino, of legal age, a resident of #844 Acacia Avenue, Ayala Alabang, Muntinlupa City;

- JIM LEWIS T. CO, Filipino, of legal age, a resident of #844 Acacia Avenue, Ayala Alabang, Muntinlupa City;

- NESSIE PEARL C. CHAN, Filipino, of legal age, a resident of #410 Agoncillo St., Ayala Alabang, Muntinlupa City;

- SANDY L. CHAN, Filipino, of legal age, a resident of #410 Agoncillo St., Ayala Alabang, Muntinlupa City;

- MARK DAVID C. CHO, Filipino, of legal age, a resident of #412 Agoncillo St., Ayala Alabang, Muntinlupa City; and

- DICK MILTON C. CHO, Filipino, of legal age, a resident of #412 Agoncillo St., Ayala Alabang, Muntinlupa City;

Victim/s

CO IT aka GONZALO CO, Filipino, of legal age, a resident of 2639 Zamora St., 1300 Pasay City, Metro Manila.

D. PROBABLE LAW INVOLVED

1. Violation of Article 315 (1)(b) of the Revised Penal Code (Estafa with Unfaithfulness or Abuse of Confidence) and Violation of Art. 172 in relation to Art 171(2) of the Revised Penal Code (Falsification by Causing it to appear that persons have participated in an act when they did not in fact participate).

2. Violation of Sections 255 of the National Internal Revenue Code (Failure to file returns, supply correct and accurate information, and pay tax).

E. MATERIAL FACTS ESTABLISHED BY EVIDENCE GATHERED.

Reference is the memorandum dated Nov. 6, 2006 issued by Secretary RAUL M. GONZALES of the Department of Justice directing his Bureau to conduct an investigation regarding the alleged illegal activities of certain personalities of GREEN CROSS INCORPORATED “GREENCROSS” per the letter complaint of one GONZALO CO, a.k.a CO IT.

In his Sworn Affidavit dated 29 December 2007, Complainant CO IT alleged that he is rightful owner of Green Cross, Inc. and that Subjects herein had connived to defraud and deprive him of his ownership thereof. Complainant further alleged that Subjects have not properly reported its income for the past several years and had defrauded the government of millions of pesos in taxes.

Subjects herein are siblings, in-laws, nephews and nieces of the Complainant CO IT and are currently the Directors and Shareholders of GREENCROSS, INC.

Complainants CO IT previously referred the matter for preventive mediation before the Philippine Kho Association, however Subjects ANTHONY CO, PETER CO, MARY CHO, SO HUA CO refused to submit themselves for mediation.

- ESTAFA with Unfaithfulness or Abuse of Confidence and Falsification by Causing it to appear that persons have participated in an act when they did not in fact so participate

GREEN CROSS INCORPORATED is a duly registered manufacturing company engaged in the manufacture of rubbing alcohol, liquid bleach, baby oil, cologne, etc. Among its major products are Green Cross Rubbing Alcohol and Zonrox Bleach. GREENCROSS started its operation in 1952, then as a sole proprietorship under the name GONZALO LABORATORY. It was later incorporated and named GONZALO LABORATORIES, INC. in 1971; thence in 1990, it was renamed GREENCROSS, INC.

In his sworn affidavit CO IT alleged that in 1952 he single-handedly established GONZALO LABORATORY as a “Sole Proprietorship”. He developed and popularized the “GREEN CROSS” and “ZONROX” brands and registered the same under his name before the Philippine Patents Office. The business became successful and so he eventually employed his siblings ANTHONY, PETER, MARY and JOSEPH to help him out in running his business.

In 1971, through the influence of his brother JOSEPH, Complainant CO IT converted his sole proprietorship business into a corporation, naming it GONZALO LABORATORIES, INC. He named his siblings ANTHONY, JOSEPH, MARY and his Mother ANG SI, as incorporators.

Complainant CO IT alleged that at the time of its incorporation in 1971, GONZALO LABORATORIES, INC., had a paid-up capital of Seventy Thousand Pesos (P70,000). He claimed that he alone provided the said capitalization.

On 29 October 1970, Complainant executed a Deed of Assignment transferring all the assets of GONZALO LABORATORY worth Sixty Six Thousand Seven Hundred Pesos (P66,700) to GONZALO LABORATORIES, INC. and deposited Three Thousand Three Hundred Pesos (P3,300) in cash. He stated that none of the other incorporators contributed money or property to the business thus he owned 100% of the company as the other shares were merely placed in trust to the other incorporators.

However to Complainants utter dismay and consternation, Subjects had taken advantage of the trust reposed upon them and had manipulated the transfer of shares that by 1986 he was left with only one GREENCROSS share, and then finally in 1997, not even a single GREENCROSS share was left under his name. Subjects had deprived him of his property shares; misappropriating and converting it to their own personal interest and refusing to return the same to him, to his damage and prejudice.

Complainant CO IT vehemently denied ever having sold or transferred his shares to Subjects ANTHONY A. CO, PETER A. CO, MARY CO CHO, SO HUA T. CO, NANCY D. CO, MICHAEL ANTHONY CO, ANN MARIE Y. CO-IMPERIAL, JOANNA LIZA CO YAP, JIM LEWIS T. CO, NESSIE PEARL C. CHAN, SANDY L. CHAN, MARK DAVID CO. CHO and DICK MILTON C. CHO.

He recalls an incident in 1986 initiated by his brother JOSEPH, who passed away in 1992, where an argument ensued between Complainant’s eldest son, SYRIL KO against his brother JOSEPH. Later, JOSEPH allegedly coerced him to choose between himself and Complainant, as to who should leave the company. To resolve the conflict and as the eldest brother, he had to sign some documents presented by JOSEPH. Later he learned that what he signed was a Deed of Assignment and a Waiver purportedly stating that he sold the 17.5% shares to his siblings and that he is waiving his right to any increase corresponding to those shares, thus in December 19, 1986, he was left with only 1 share.

Complainant however denies ever voluntarily intending to sell or transfer the 17.5% shares, he recalls that he never appeared before a notary to give force and effect to the aforesaid document. He explains further that assuming arguendo that the sale was valid, he should still own 82.,5% as he owned 100% of the company. Now he realizes that his siblings had orchestrated a grand plan to force him out of his own company.

Even the 33.4% shares, which according to Complainant, he placed trust under the names of his mother ANG SI and father CO AY TIAN, were distributed only among his siblings ANTHONY, PETER, MARY and JOSPEH, after their parents’ deaths. Thus, even assuming arguendo that 33.4% shares were to be treated as inheritance, Complainant stresses that he should have, at the very least, received his 1/5 share. He further averred that there was no extrajudicial settlement of their parents’ estate, thus no corresponding inheritance or transfer taxes were paid.

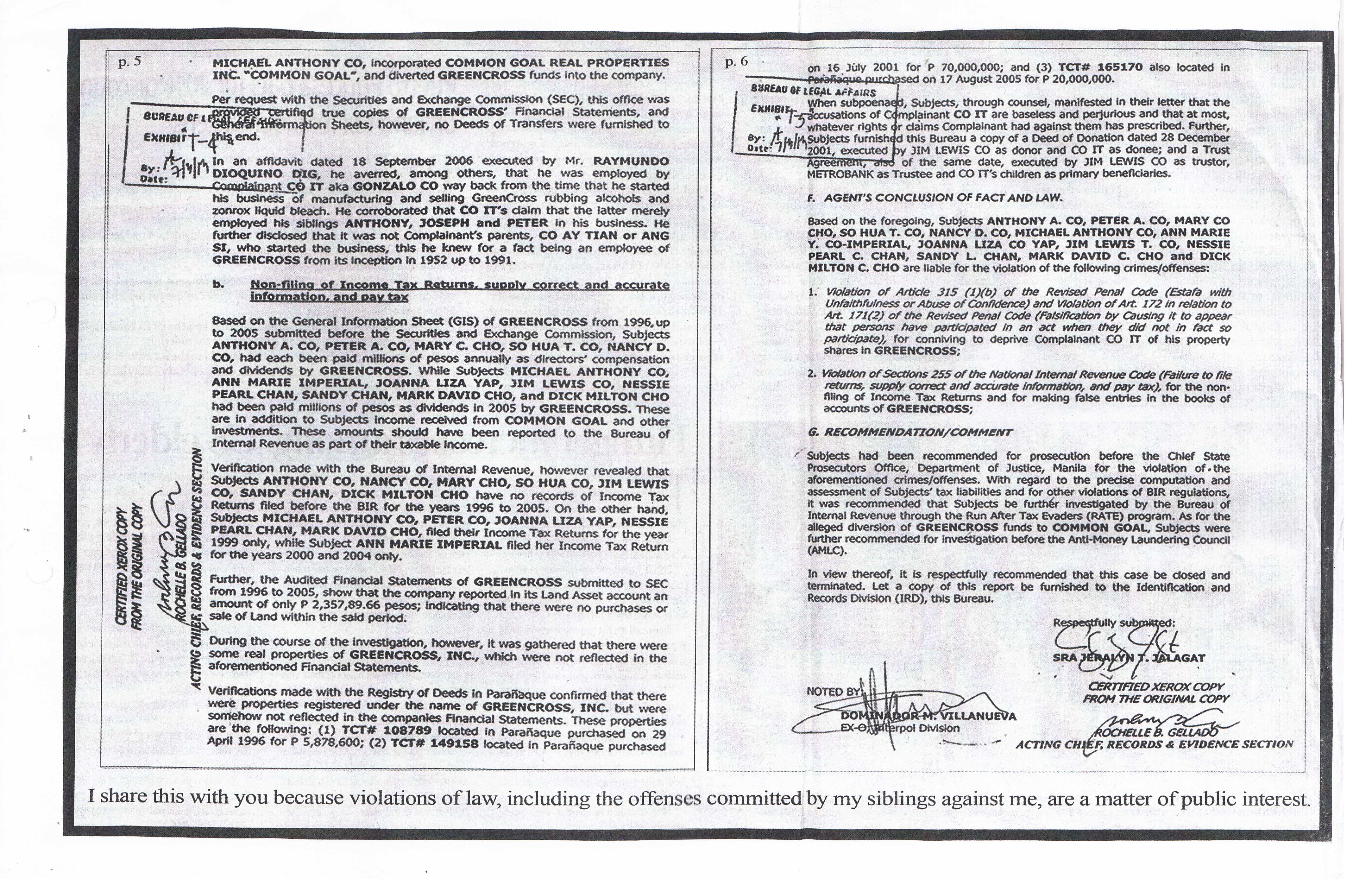

Complainant further alleged that in 2004, to keep the company from him as far as possible, his siblings had taken their own children namely Subjects MICHAEL ANTHONY CO, ANN MARIE Y. CO-IMPERIAL, JOANNA LIZA CO YAP, JIM LEWIS T. CO, NESSIE PEARL C. CHAN, SANDY L. CHAN, MARK DAVID C. CHO and DICK MILTON C. CHO, into the company and made them shareholders, reflecting big amounts of money as paid-up capital, but in reality, there were taken from GREENCROSS funds.

|

Name |

Green Cross |

Common Goal |

Total Investments |

| ANTHONY A. CO |

29,010,238 |

120,000,000 |

149,010,238 |

| PETER A. CO |

14,505,120 |

72,500,000 |

87,005,120 |

| NANCY D. CO |

14,505,120 |

72,500,000 |

87,005,120 |

| MARY CO CHO |

12,969,384 |

65,000,000 |

77,969,384 |

| SO HUA T. CO |

29,010,138 |

120,000,000 |

149,010,138 |

| MICHAEL ANTHONY CO |

18,131,250 |

70,312,500 |

88,443,750 |

| ANN MARIE IMPERIAL |

18,131,250 |

45,312,500 |

63,443,750 |

| JOANNA LIZA YAP |

18,131,250 |

70,312,500 |

88,443,750 |

| JIM LEWIS T. CO |

18,131,250 |

45,312,500 |

63,443,750 |

| NESSIE PEARL C. CHAN |

18,131,250 |

45,312,500 |

63,443,750 |

| SANDY L. CHAN |

18,131,250 |

45,312,500 |

63,443,750 |

| MARK DAVID CHO |

8,106,250 |

20,312,500 |

28,418,750 |

| DICK MILTON CHO |

8,106,250 |

20,312,500 |

28,418,750 |

Complainant alleged that sometime in 1995 Subjects ANTHONY A. CO, PETER A. CO, MARY CO CHO, SO HUA T. CO, NANCY D. CO, JOANNA LIZA CO, MICHAEL ANTHONY CO, incorporated COMMON GOAL REAL PROPERTIES INC. “COMMON GOAL”, and diverted GREENCROSS funds into the company.

Per request with the Securities and Exchange Commission (SEC), this office was provided certified true copies of GREENCROSS’ Financial Statements, and General Information Sheets, however, no Deeds of Transfers were furnished to this end.

In an affidavit dated 18 September 2006 executed by Mr. RAYMUNDO DIOQUINO DIG, he averred, among others, that he was employed by Complainant CO IT aka GONZALO CO way back from the time that he started his business of manufacturing and selling GreenCross rubbing alcohols and zonrox liquid bleach. He corroborated that CO IT’s claim that the latter merely employed his siblings ANTHONY, JOSEPH and PETER in his business. He further disclosed that it was not Complainant’s parents, CO AY TIAN or ANG SI, who started the business, this he knew for a fact being an employee of GREENCROSS from its inception in 1952 up to 1991.

b. Non-filing of Income Tax Returns, supply correct and accurate information, and pay tax

Based on the General Information Sheet (GIS) of GREENCROSS from 1996 up to 2005 submitted before the Securities and Exchange Commission, Subjects ANTHONY A. CO, PETER A. CO, MARY C. CHO, SO HUA T. CO, NANCY D. CO, had each been paid millions of pesos annually as directors’ compensation and dividends by GREENCROSS. While Subjects MICHAEL ANTHONY CO, ANN MARIE IMPERIAL, JOANNA LIZA YAP, JIM LEWIS CO, NESSIE PEARL CHAN, SANDY CHAN, MARK DAVID CHO, and DICK MILTON CHO had been paid millions of pesos as dividends in 2005 by GREENCROSS. These are in addition to Subjects income received from COMMON GOAL and other investments. These amounts should have been reported to the Bureau of Internal Revenue as part of their taxable income.

Verification made with the Bureau of Internal Revenue, however revealed that Subjects ANTHONY CO, NANCY CO, MARY CHO, SO HUA CO, JIM LEWIS CO, SANDY CHAN, DICK MILTON CHO have no records of Income Tax Returns filed before the BIR for the years 1996 to 2005. On the other hand, Subjects MICHAEL ANTHONY CO, PETER CO, JOANNA LIZA YAP, NESSIE PEARL CHAN, MARK DAVID CHO, filed their Income Tax Returns for the year 1999 only, while Subject ANN MARIE IMPERIAL filed her Income Tax Return for the years 2000 and 2004 only.

Further, the Audited Financial Statements of GREENCROSS submitted to SEC from 1996 to 2005, show that the company reported in its Land Asset account an amount of only P2,357,89.66 pesos; indicating that there were no purchases or sale of Land within the sale period.

During the course of the investigation, however, it was gathered that there were some real properties of GREENCROSS, INC., which were not reflected in the aforementioned Financial Statements.

Verifications made with the Registry of Deeds in Parañaque confirmed that there were properties registered under the name of GREENCROSS, INC. but were somehow not reflected in the companies Financial Statements. These properties are the following: (1) TCT# 108789 located in Parañaque purchased on 29 April 1996 for P5,878,600; (2) TCT# 149158 located in Parañaque purchased on 16 July 2001 for P70,000,000; and (3) TCT# 165170 also located in Parañaque purchased on 17 August 2005 for P20,000,000.

When subpoenaed, Subjects, through counsel, manifested in their letter that the accusations of Complainant CO IT are baseless and perjurious and that at most, whatever rights or claims Complainant had against them has prescribed. Further, Subjects furnished this Bureau a copy of a Deed of Donation dated 28 December 2001, executed by JIM LEWIS CO as donor and CO IT as donee; and a Trust Agreement, also of the same date, executed by JIM LEWIS CO as trustor, METROBANK as Trustee and CO IT’s children as primary beneficiary.

F. AGENTS CONCLUSION OF FACT AND LAW.

Based on the foregoing, Subjects ANTHONY A. CO, PETER A. CO, MARY CO CHO, SO HUA T. CO, NANCY D. CO, MICHAEL ANTHONY CO, ANN MARIE Y. CO-IMPERIAL, JOANNA LIZA CO YAP, JIM LEWIS T. CO, NESSIE PEARL C. CHAN, SANDY L. CHAN, MARK DAVID C. CHO and DICK MILTON C. CHO are liable for the violation of the following crimes/offenses:

- Violation of Article 315 (1)(b) of the Revised Penal Code (Estafa with Unfaithfulness or Abuse of Confidence) and Violation of Art. 172 in relation to Art. 171(2) of the Revised Penal Code (Falsification by Causing it to appear that persons have participated in an act when they did not in fact so participate), for conniving to deprive Complainant CO IT of his property shares in GREENCROSS;

- Violation of Sections 255 of the National Internal Revenue Code (Failure to file returns, supply correct and accurate information, and pay tax), for the non-filing of Income Tax returns and for making false entries in the books of accounts of GREENCROSS;

G. RECOMMENDATION/COMMENT

Subjects had been recommended for prosecution before the Chief State Prosecutors Office, Department of Justice, Manila for the violation of the aforementioned crimes/offenses. With regard to the precise computation and assessment of Subjects’ tax liabilities and for other violations of BIR regulations, it was recommended that Subjects be further investigated by the Bureau of Internal Revenue through the Run After Tax Evaders (RATE) program. As for the alleged diversion of GREENCROSS funds to COMMON GOAL, Subjects were further recommended for investigation before the Anti-Money Laundering Council (AMLC).

In view thereof, it is respectfully recommended that this case be closed and terminated. Let a copy of this report be furnished to the Identification and Records Division (IRD), this Bureau.

Respectfully submitted:

SRA JERALYN T. JALAGAT

NOTED BY:

DOMINADOR M. VILLANUEVA

EX-O Interpol Division

CERTIFIED XEROX COPY

FROM THE ORIGINAL COPY

ROCHELLE B. GELLADO

ACTING CHIEF, RECORDS & EVIDENCE SECTION

I share this with you because violations of law, including the offenses committed by my siblings against me, are a matter of public interest.